What is the SAMA Compliance Framework?

SAMA compliance is the regulations set by the Saudi Arabian Monetary Authority for protecting the integrity and security of the financial sector. It ensures that banking organizations in Saudi Arabia follow strict standards for data protection, cybersecurity, and risk management. It controls and regulates the processes, legalities, and information security strategies of all regional banking organizations and financial enterprises. Compliance with SAMA is crucial for maintaining customer as well as stakeholder trust and confidence, while also protecting against data breaches and cyberattacks.

What are the Data Security requirements for SAMA Compliance?

To comply with the SAMA compliance framework, businesses in the financial sector must adhere to these key data security requirements:

Data Encryption

All financial data must be encrypted in transit and at rest to protect against unauthorized access. Data encryption ensures that even if data is intercepted, it remains unreadable on platforms like Jira and Confluence without the appropriate decryption keys.

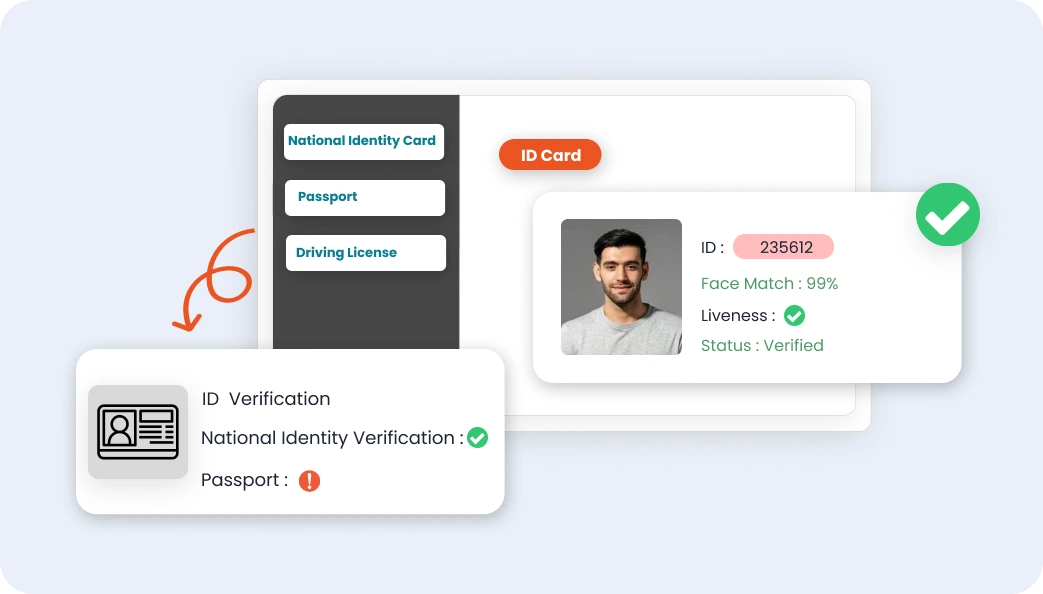

Access Controls

Strong user authorization and authentication should be in place to ensure that only verified personnel can access sensitive financial information. This includes two-factor authentication (2FA) for accessing critical cloud apps and role-based access controls (RBAC). For instance, CASB can monitor and control access to cloud apps like Confluence from unmanaged devices.

Data Loss Prevention (DLP)

Measures must be implemented to detect and prevent data breaches or leaks. DLP technologies monitor data flows and enforce policies to prevent unauthorized data transfers.

Audit and Monitoring

Continuous monitoring and auditing of data access and activity are required to detect and respond to security incidents promptly. This involves logging all access and changes to sensitive data and regularly reviewing these logs for suspicious activities.

Risk Management

Institutions must conduct regular risk assessments and implement strategies to mitigate identified risks. This includes identifying potential threats, evaluating the impact and likelihood of these threats, and implementing appropriate controls to reduce risk to an acceptable level.

SAMA Compliance with CASB Solution

miniOrange Cloud Access Security Broker (CASB) acts as a middleman between banking firms and cloud service providers, offering improved visibility and control over data security. Here's how CASB can help comply with the SAMA compliance framework:

Data Protection

CASB offers robust data encryption and tokenization capabilities, ensuring that sensitive information is protected, both in transit and at rest. This aligns with SAMA's requirement for robust encryption practices.

Visibility and Control

CASB solution provides complete visibility into cloud usage, allowing financial institutions to monitor and control access to sensitive data effectively. This includes tracking who is accessing data, from where, and what actions they are taking.

Compliance Management

CASB comes with tools to enforce compliance policies and generate audit logs, simplifying the process of maintaining compliance with SAMA regulations. This includes automated policy enforcement and real-time compliance reporting.

Threat Protection

Advanced threat protection features in CASB help detect and mitigate potential security threats, ensuring a proactive approach to cybersecurity. This includes detecting unusual behavior that may indicate a security threat and automatically taking action to mitigate the risk.

Benefits of CASB for Financial Data Security

miniOrange CASB integration with data security strategy offers several benefits for financial institutions:

Enhanced Security

CASB provides an additional layer of security, protecting financial institutes against data breaches and cyber threats. They offer features like User Behavior Analytics (UBA), which can detect anomalies that may indicate a security incident.

Regulatory Compliance

With built-in compliance management tools, CASB simplifies the process of meeting regulatory requirements like SAMA. They help ensure that all compliance policies are consistently implemented and provide detailed reports to demonstrate compliance.

Improved Visibility

Gain insights into cloud usage and data access patterns, enabling better risk management. This visibility helps institutions detect and address possible security issues before they cause serious damage.

Cost Efficiency

By consolidating security functions into a single platform, CASB reduces the overall cost of compliance and security management. This includes lowering the need for multiple security tools and simplifying security policy management.

Working of CASB for SAMA Compliance

Let's consider two staff users working within a financial services company in Riyadh. John is a Senior Financial Analyst, while Alice is an IT Security Specialist working on a project involving confidential financial data, and they need to collaborate using Confluence. They must ensure compliance with SAMA regulations while sharing and managing this sensitive information.

With a CASB solution in place, Alice detects and prevents the sharing of sensitive financial data outside the organization. The CASB monitors documents within Confluence and alerts the security team if any unauthorized sharing attempts occur.

The CASB provides real-time visibility into user activities. For instance, if John attempts to access a restricted document, an alert is generated for Alice to review.

This is how the miniOrange CASB solution works in real-time to control access for users, ensuring the security of financial data and enforcing SAMA Compliance for financial service providers.

In Summary

In this blog, we learned how to comply with SAMA compliance and why it is essential for financial institutions operating in Saudi Arabia. Leveraging miniOrange Cloud Access Security Broker (CASB) can simplify this process by providing enhanced control, visibility, and security over sensitive financial data. By integrating our CASB solution, financial institutions can not only meet SAMA compliance framework requirements but also boost their overall data security posture.

Additional Resources

Check out more resources by miniOrange for cloud security.

Leave a Comment