With hackers always on the lookout for weak links, such as simple passwords that are easy to crack, ensuring the right individuals have access to the right resources without compromising privacy is crucial. That’s where digital identity security comes to the rescue. But what is digital identity?

In this article, we’ll dive into digital identity definition, what digital identity really means, and why it’s a game-changer for protecting our information. We’ll also explore how digital identity works, the importance of digital identity protection, and the potential of decentralized digital identity solutions.

Let’s dive in!

What is Digital Identity?

Digital identity, often called a digital ID, is the information that proves who you are in the digital world. Instead of using traditional IDs like usernames and passwords, your digital identity uses government-based IDs, social media accounts like Google or Facebook, or even cryptographic keys to verify you online. Whether logging into apps, making online purchases, or accessing services, your digital identity keeps things secure and ensures only you have access to your personal info. It’s all about making your online experience easier and safer.

Why is Digital Identity Important for Businesses?

Digital identity is crucial for modern business operations as it helps ensure that only authorized employees or customers can access sensitive data, apps, and services. By verifying users through digital identities, businesses can experience the following benefits:

Better Security Against Identity Thefts

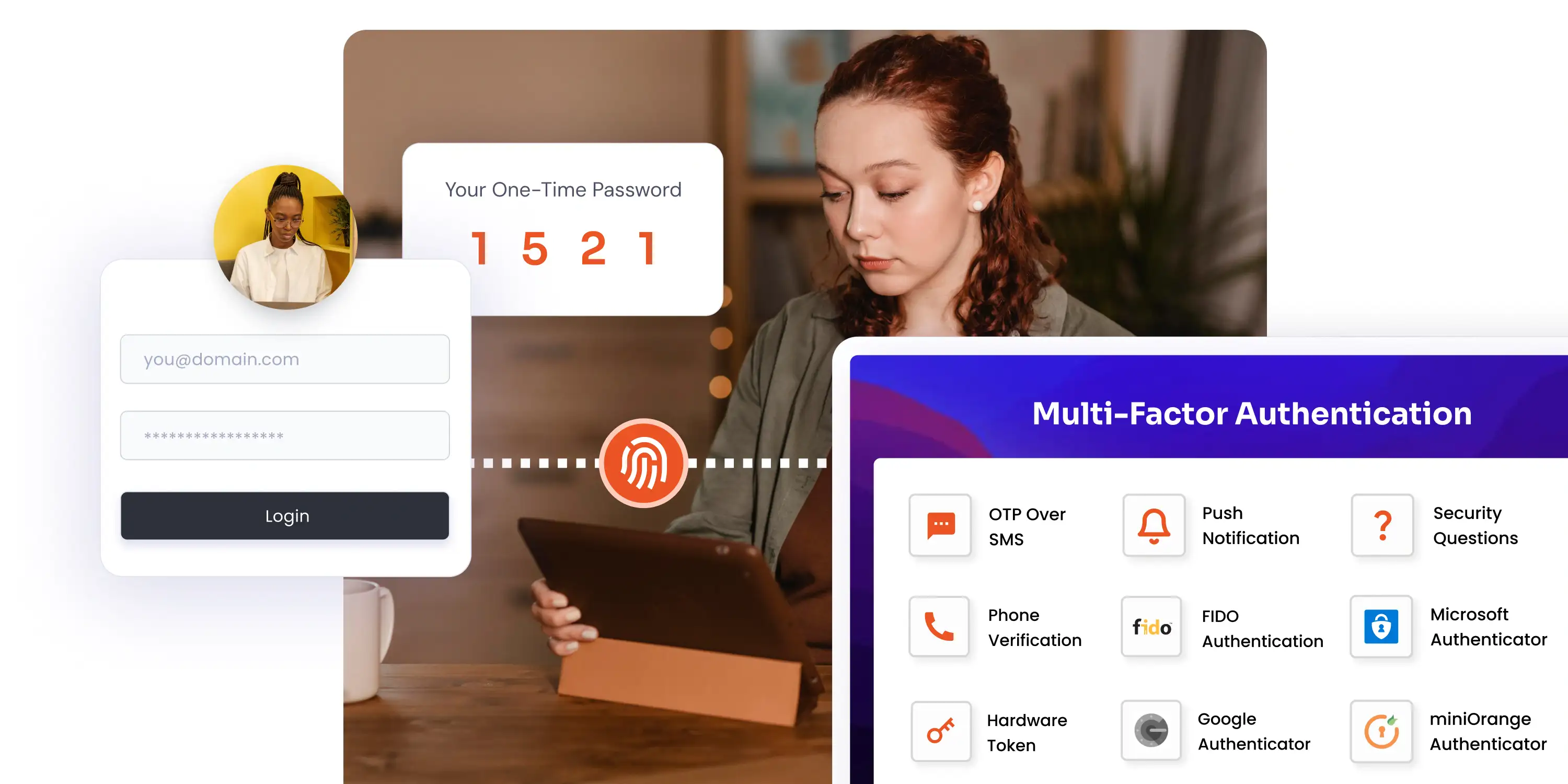

One big benefit of using digital ID is its strong security. Businesses can ensure only the right person accesses their accounts. They can protect important data from digital identity theft and fraud using advanced security measures like data encryption and Multi-Factor Authentication (MFA).

Greater Convenience

Digital identity transforms how employees and customers interact with online services. With a single, verified digital identity, businesses can quickly and efficiently authenticate their users or staff using specific digital identifiers. This approach not only saves time but also reduces the hassle of managing multiple accounts and remembering numerous passwords.

Flexibility & Personalized User Experience

As more people work from home and use online services, digital identity has become essential. It helps companies stay compliant and protect their assets in a rapidly changing technology landscape.

Moreover, digital identities can be securely stored in digital wallets that can be customized to fit each user's needs and preferences. This personalization improves user satisfaction and provides businesses with a new way to add value and build strong relationships with their customers.

Global User Access and Connectivity

Digital identities make it easier for businesses to work with people globally. This enables businesses to expand internationally, manage payments from various locations, and collaborate with partners worldwide.

How Does Digital Identity Work?

Digital identity works on the principles of verifying unique information about a user to grant access to an application or website. These digital IDs can be as simple as a security PIN or more advanced, like a smartphone credential or government-issued ID.

When a user tries to log in, businesses can verify their digital ID against a stored ID to confirm their identity. This process is quick, secure, and ensures that only authorized individuals access specific resources.

Many digital identity solutions also incorporate multi-factor authentication (MFA), which adds an extra layer of security by requiring an additional step, such as entering a one-time password (OTP) sent to the user’s phone. Understanding how digital identity works is essential in today’s digital landscape, where identity theft and security are major concerns. With effective digital identity protection, users can ensure that their information remains secure and safeguarded against potential threats.

Types of Digital Identity

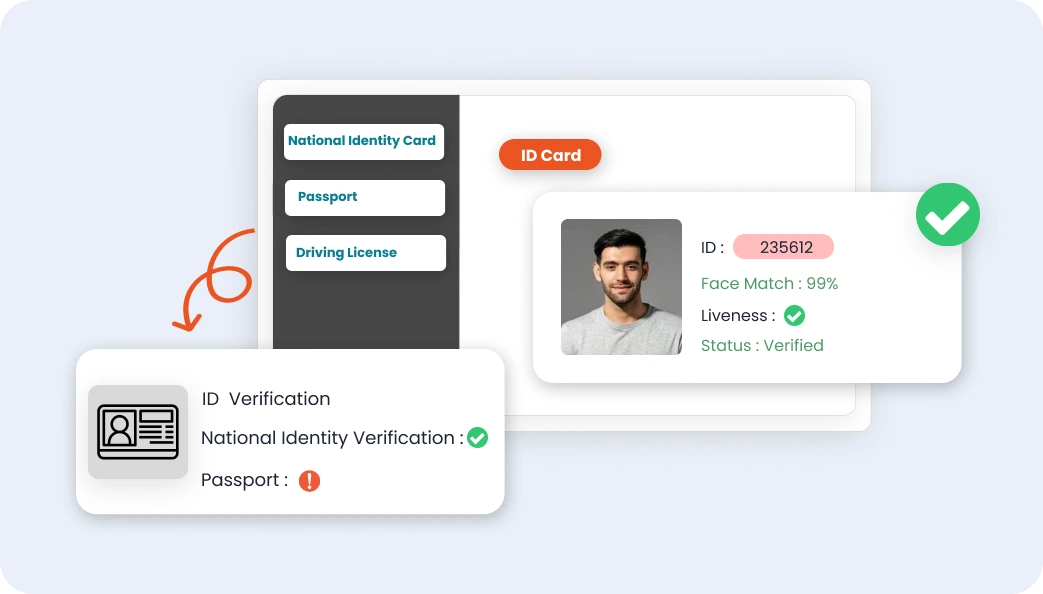

- Government-Issued Digital ID

These digital IDs represent government-issued identification like passports, driver's licenses, or national IDs. They are typically used for verifying a citizen's identity in both offline and online environments.

Examples: Gov.UK Verify (UK), Aadhaar (India), eID (Estonia).

- Financial Digital ID

Digital identities associated with financial institutions are primarily used for banking, payments, and other financial services. They ensure secure transactions and protect against fraud, highlighting the importance of digital identity protection.

Examples: PayPal ID, BankID (Sweden).

- Social Media and Platform ID

Users can verify their identity across multiple social media platforms using these digital identities, which are generated by social media sites or online services.

Examples: Google Account, LinkedIn profile, Facebook ID, Apple ID.

- Federated IDs

These digital identities, enabled by federated authentication standards like SAML or OAuth, allow users to access multiple services with a single set of credentials. This is a key aspect of how digital identity works.

Examples: Single Sign-On (SSO) systems like Okta, Microsoft Azure AD.

- Blockchain-Based Digital ID

Blockchain networks store these decentralized digital identities, providing individuals with control over their personal information and enabling secure, unalterable authentication. This is a prime example of digital identity using blockchain technology.

Examples: Sovrin, uPort, SelfKey.

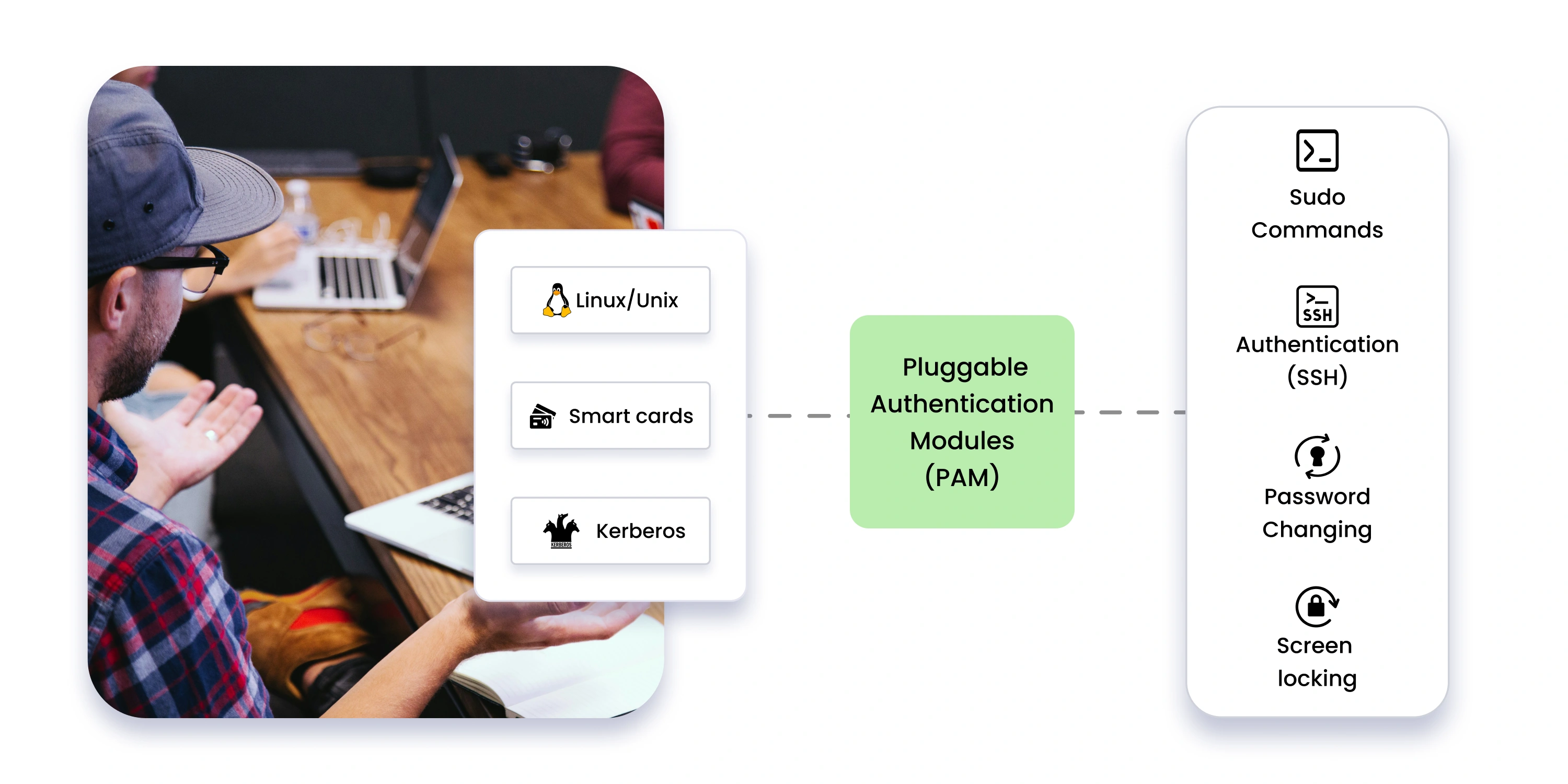

- Corporate/Enterprise Digital ID

Businesses use these digital identities to verify employee identities and provide access to various physical and digital company resources, ensuring digital identity security within the organization.

Examples: Company-issued smart cards or badges, Active Directory identities.

- Decentralized Identity (DID)

In this model, individuals own and control their digital identity, with no central authority managing their information. It utilizes cryptographic proofs, like blockchain, to verify identity, showcasing the benefits of digital wallets in providing secure access.

Examples: Decentralized IDs from Microsoft, Verifiable Credentials.

Common Uses of Digital Identity

Digital identity security is essential for businesses as it helps protect sensitive information, streamline operations, and enhance customer trust. Here are some common uses for digital identity security in businesses:

- eCommerce & Consumer Identity

Digital IDs are used in eCommerce to verify user identities, authenticate online shoppers, and prevent fraud during checkout processes. Example: Verifying digital identity for age-restricted purchases like alcohol or other regulated products in online stores. - Healthcare Systems

In healthcare, digital IDs streamline access to medical records, appointment systems, and telemedicine platforms. They ensure that sensitive data is securely handled and shared among authorized personnel. Example: Patients use digital IDs to securely access their medical records, schedule telehealth appointments, and grant temporary access to their doctors. - Financial Transactions

In the finance sector, digital IDs play a significant role in Know Your Customer (KYC) processes, digital banking, and secure payment systems. They are used to verify identities and prevent fraud. Example: Verifying a user’s identity during cryptocurrency transactions or transferring funds across borders using blockchain technology. - Cross-border Travel & Immigration

Many countries use digital IDs for international travel, enabling more secure and streamlined border control and visa processes.

Digital Identity: Use Case

Mobile Banking with Digital Identity

- Identity Verification:

When a user signs up for a mobile banking app, they are required to provide personal information like a government-issued ID (e.g., a passport or driver’s license) and undergo identity verification, often by submitting a selfie or video for facial recognition. - Digital Identity Creation:

Once verified, the bank creates a digital identity for the user. This digital identity consists of verified personal data tied to the user's account and mobile device. - Secure Login:

When accessing the app, the user can log in using multi-factor authentication (MFA), such as biometric authentication, or a one-time password (OTP) sent via SMS or email. The digital identity ensures that only the verified user can access their bank account, thus enhancing digital identity security. - Transaction Authorization:

When making transactions, the app uses the user’s digital identity to validate their identity in real-time, ensuring secure payments. For example, to transfer money or make online purchases, the user might be asked to authenticate using facial recognition to confirm that the transaction is authorized by them. - Monitoring and Alerts:

The digital identity system constantly monitors the user’s login patterns, device information, and location. If unusual activity is detected (e.g., login from a new device or location), the system might trigger additional identity checks, like sending an alert or requesting MFA, to protect the user’s account. This proactive approach is essential for digital identity protection against threats like digital identity theft.

Risks of Digital Identity

While digital identities offer multiple benefits, they also come with certain risks. A key concern is the possibility of data breaches. If a hacker gets hold of your digital identity, they could steal personal information, leading to digital identity theft. Another risk is the misuse of your data by organizations, which could invade your privacy.

To reduce these risks, many digital identity solutions use strong security features like encryption and digital identity on blockchain to protect your information. However, it’s still important for users to take precautions, such as using strong passwords and enabling multi-factor authentication (MFA), to keep their digital identities safe.

How to Choose a Digital Identity Security Solution?

Choosing a digital identity security solution is crucial for ensuring compliance and user trust. Here’s a comprehensive guide to help you make an informed decision:

Step 1: Assess Your Business Needs

Determine why you need identity verification in the first place. Is it for KYC compliance, fraud prevention, or user onboarding? Consider any industry-specific regulations (e.g., financial services, healthcare) that may influence your choice.

Step 2: Evaluate the Service Provider

Look for a service provider that offers a variety of verification methods, such as document verification (e.g., passports, Government IDs), and biometric verification (e.g., facial recognition, fingerprints). Ensure the service can easily integrate with your existing systems, APIs, and workflows. Understanding what is digital identity and how it applies to your business will help you in this process.

Step 3: Check Security Features & User Experience

Ensure the service complies with data protection regulations (e.g., GDPR, CCPA). Choose a service that offers a smooth and user-friendly experience for your customers. Investigate the digital identity protection measures in place, including encryption and data anonymization.

Step 4: Test the Service

Take advantage of a free trial or demo to assess the service’s functionality and performance. Evaluate the quality of customer support offered, including availability and responsiveness. Inquire about the benefits of digital wallets if applicable to your service, as they can enhance the user experience.

Step 5: Plan for Scalability

Choose a service that can scale with your business as it grows, accommodating increasing verification volumes. This is especially important for businesses considering decentralized digital identity solutions as scalability can be a significant factor.

Step 6: Check for Customer Support

Consider consulting with experts or industry peers who have experience with digital identity verification services. Understanding digital identity security can also be enhanced through collaboration and learning from others in your field.

How miniOrange Can Help?

miniOrange makes it easier and safer for companies to handle people's personal information. It helps businesses in sectors like banking, healthcare, education, and corporate to figure out who they're really dealing with.

The cool thing is that it gives users control over their digital identity and changes how businesses handle information. We've made a simple and secure system that lets companies and people safely share sensitive personal details, but only when given permission. This approach ensures digital identity protection and enhances overall digital identity security.

With our solutions, businesses can effectively manage digital identifiers while minimizing the risks associated with digital identity theft. Moreover, our digital identity solutions are designed to help organizations ensure they comply with regulations and maintain customer trust.

For more information about our digital identity security solution, contact our tech experts at info@xecurify.com.

Additional Resources:

Author

Leave a Comment