Need Help? We are right here!

Search Results:

×Digital identity verification uses encrypted credentials and secure digital wallets to confirm a user’s identity online. Unlike traditional methods, identity verification software offers real-time, privacy-centric authentication that meets global compliance standards while putting control back in the user’s hands.

Everything You Need to Secure Access Without Compromising UX.

Eliminate the need for passwords to access WordPress, Shopify, and more using your digital identity verification. Control user access to ensure they can only view authorized data and resources.

Secure your digital data with identity verification solutions and decentralized identities, ensuring only verified users access your accounts and information.

Meet regulatory compliance for GDPR, eIDAS 2.0, HIPAA-compliant identity verification, KYC verification, and CCPA requirements with secure ID verification and digital credentials.

Manage multiple digital IDs into a single, secure wallet like Microsoft Authenticator, Dock Wallet, and more for seamless, password-free access.

Control digital ID data with customizable privacy settings and selective information sharing with identity verification solutions.

Strengthen app security by adding extra verification steps beyond just a password and using a verified decentralized identity.

A Smarter, Simpler Way to Prove Identity—Built for the Enterprise.

The identity verification process begins with a trusted entity, such as a government, business, or institution, that creates & issues a signed identity credential having attributes like the holder's name and date of birth. This forms the foundation of digital identity verification.

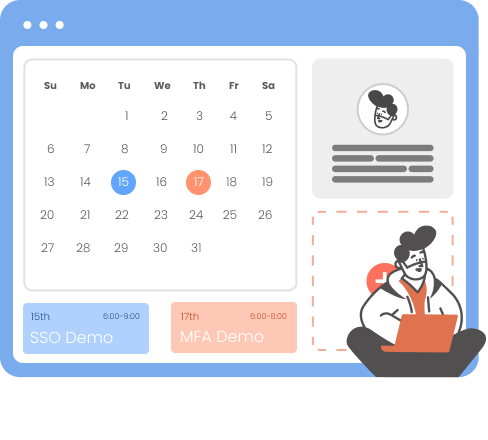

The Holder, an individual to whom the credential is issued, stores their secure digital identity in a trusted digital wallet. This ensures safe and reliable digital ID storage, making it easy for identity verification software to access and authenticate the credential when needed.

When the Holder attempts to access a service, the Verifier—typically part of a digital identity platform—initiates an online identity verification process. The system requests the credential to begin identity authentication.

Using cryptographic identity verification, the Verifier checks the Issuer's digital signature to confirm the authenticity of the credential. Once validated, the digital identity verification is complete, and the ID authentication software grants access to the requested service.

The Verifier authenticates the Holder using a verified identity, granting secure access to the service. With successful digital identity verification through a trusted digital identity platform, users enjoy seamless entry.

Try password-free, compliant, and privacy-first digital ID authentication today.

One Platform. Infinite Use Cases.

Strengthen your e-commerce operations with digital identity verification for eCommerce . Track and manage supplier, partner, and customer identities across the supply chain. Ensure transparency, enhance trust, and enable fraud prevention with digital ID. Get secure online identity verification to protect every transaction and user interaction.

Supported Digital ID wallets: Microsoft Authenticator, eIDAS 2 (European Union), NemID/MitID (Denmark), IDnow, and more.

miniOrange digital ID login platform integrates seamlessly with your existing infrastructure. From WordPress to Atlassian, Shopify to Moodle, our digital wallet authentication integration support:

Get the clarity you need before you commit.